Borrowers Often Start with the Wrong Question

Once Borrowers understand that it is the Borrower that chooses the interest rate and not the lender, the question that often follows is, “Is it better to pay more upfront cost and get a better interest rate, or take a higher rate and receive a lender credit?” The answer to this question is very simple as long as the borrower can answer the more important question of, “How long will the Borrower have this loan?” This is because once the Borrower knows how long they will have this loan, the numbers tell the story as to which rate/cost option is right for them.

The Cost-Adjusted-Payment Method of Choosing Interest Rate

The Borrower must weigh the cost benefits associated with each interest rate choice. One way to do this is to divide the cost or credit associated with a particular interest over the life of the loan to determine the Cost-Adjusted-Payment.

An Example:

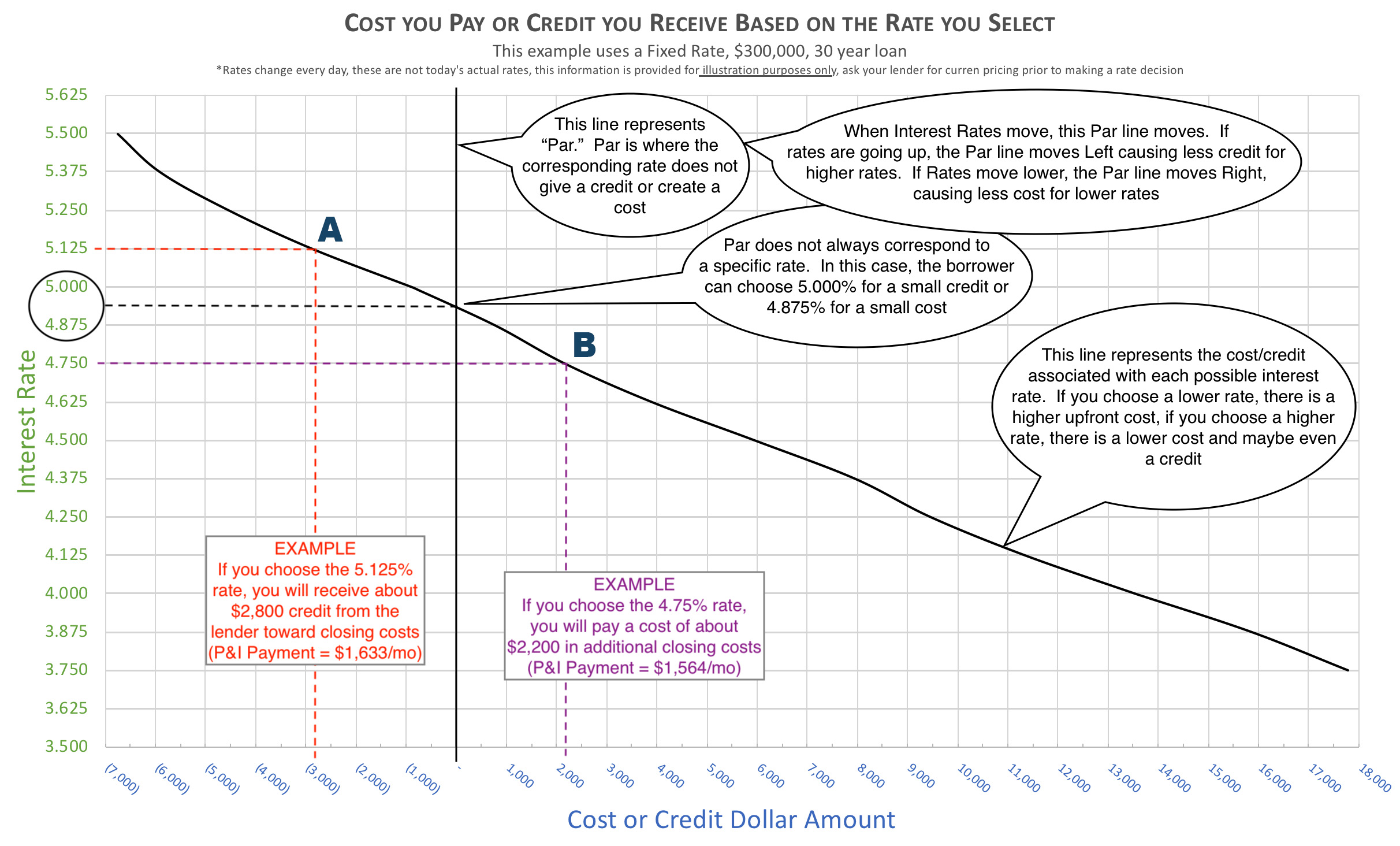

A Borrower is choosing an interest rate for a $300,000, 30 year fixed rate loan. If the Borrower chooses the 5.125% rate, the borrower will receive a credit of $2,800 toward closing costs. If the Borrower chooses the 4.75% rate, the borrower will be required to pay an additional $2,200 in loan origination fees at the close of the transaction.

- The 5.125% rate will cause Borrower’s monthly Principal and Interest (P&I) payment to be $1,633 per month. The credit received for choosing this rate will be $2,800 or $7.78 per month spread over the life of the loan (2800 / 360 months = 7.78). The net result is a cost-adjusted-payment of $1,625.22 per month (1633 – 7.78 = 1625.22.) (See “A” on Chart.)

- The 4.75% rate will cause Borrower’s monthly P&I payment to be $1,564. The cost associated with this rate will be $2,200 or $6.11 per month over the life of the loan. The net result is a cost-adjusted-payment of $1,570.11 (1564 + 6.11 = 1570.11). (See “B” on Chart.)

The clear choice in this example is the 4.75% rate despite the added upfront cost associated with that rate but this is not always the case.

How long will the Borrower have this loan?

The typical home loan is amortized over 30 years. But the vast majority of home loans payoff far earlier than 30 years due to sale or refinance. Depending on which government statistic, public poll or blog you are reading, the average American moves about every 7 years. So even though the loan is amortized over 30 years, that doesn’t mean the Borrower will have the loan for the full 30 year term. Even in cases where the Borrower stays in the home for more than 7 years, the Borrowers will often refinance the loan prior the 30 year term.

If we assume the borrower in our example above knows they plan to move in 20 years, then the calculation will be:

- 5.125% rate will cause borrower’s P&I payment to be $1,633 per month. The credit received for choosing this rate will still be $2,800 but now we will divide the credit by 240 months instead of 360 months because the borrower plans to move in 20 years (20 x 12 months = 240). Therefore, the monthly savings from the upfront credit is $11.67 per month resulting in a cost-adjusted-payment of $1,621.33 (1633 – 11.67 = 1621.33).

- 4.75% rate will give the borrower a P&I payment of $1,564 per month. The cost of this rate is $2,200 or $9.17 per month over 20 years resulting in a cost-adjusted-payment of $1,573.17 per month (1564 + 9.17 = 1,573.17)

The clear choice still seems to be the lower rate, despite the upfront cost. Now let’s assume that the Borrower knows they want to sell the property in the next 5 years.

- 5.125% rate has a credit of $2,800 or $46.47 per month over 5 years (2800 divided by 60 months) resulting in a cost-adjusted-payment of $1,586.53 (1633 – 46.47 = 1586.53).

- 4.75% rate has a cost of $2,200 or $36.67 per month over 5 years resulting in a cost-adjusted payment of $1600.37 (1564 + 36.67 = 1600.37).

In this example, the clear winner is the higher rate and lower upfront cost.

These two examples illustrate that, by knowing how long the Borrower will have the loan, makes the interest rate decision an obvious one.

Generally speaking, when choosing an interest rate:

- if the loan will be in place for longer than about 10 years, it is better to choose the lower rate and pay the upfront cost

- if the loan will be in place for about 5 years or less, then it is better to choose the higher rate and receive the lender credit

- If the loan will be in place for between 5 and 10 years, the good news is that it almost doesn’t matter which rate/cost option you choose because the way interest rates are priced makes it virtually a break-even decision regardless of the rate you choose.

These general rules do not always apply, so the best policy is to run the numbers with your Lender and make an educated decision about what rate is best for you.

Level of certainty is important

The borrower’s level of certainty of how long the loan will be in place, should be considered when choosing the rate. This is because, the benefits gained by making the right rate choice based on the life of the loan are greater, the further out the rate choice is in relation to Par.

For example, if a borrower is very certain they will be keep the loan for a longer duration (15, 20, 30 years) and have determined that the lower rate, higher cost option is better for them, then they should choose the lowest rate they can afford, because the benefits gained by the lower rate choice are greater, the lower the rate is.

Conversely, if the borrower is very certain they will only have the loan for a short period of time, and they have determined that the higher rate and lender credit option is best for them, then the benefits will be greater the higher the rate is.

The important thing to understand is that if the Borrower is VERY certain of the loan life, then a more extreme (one direction or the other) interest rate choice is warranted. In fact, the Borrower will enjoy more cost benefits, the more extreme the interest rate choice. However, a word of caution here is that if the borrower makes an extreme interest rate choice based on the predicted loan life, and then their plans change during the life of the loan to keep the loan significantly longer or shorter than originally expected, then the costs benefits from the extreme rate choice are lost and will actually cost the borrower much more in the long run.

If the Borrower is not VERY certain how long the loan will be in place, then the best interest rate choice is one at or near Par.

What if we have no idea how long we need the loan?

The interest rates at or near Par serve as a great default choice when the Borrower unable to predict of the life of the loan with any certainty. The reason is twofold. First, the rates at or near Par, provide the Borrower a fair cost benefit compared to the more extreme rates further away from Par. Second, if the Borrower is unsure how long they will have the loan, statistically speaking, it can be assumed that this loan life will fall within the national average of 5 to 10 years, in which case, the rates near Par are just as good as any other.

For these reasons, it is no wonder that most Borrowers choose a rate at or near Par.